Company Tax Computation Format Malaysia

Salaries of the employees of both private and public sector organizations are composed of a number of. Mobile TaxComp - Allow users to compute TaxCompe-filing at anytime and anywhere.

Malaysia Tax Computation Format Fill Online Printable Fillable Blank Pdffiller

Inclusive of Personal e-Filing.

. HRA or House Rent allowance also provides for tax exemptions. The selling price of a product charged by the parent company to the subsidiary company may differ from the selling price with an independent third party. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Get 247 customer support help when you place a homework help service order with us. The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. MALAYSIAN TAXATION 2 covers tax computation for partnership and company which includes the deductions of capital allowances and investment incentives as provided under the tax laws and continues with computation of real property gains tax and indirect.

Article 9 OECD Model Tax Convention On Income and On Capital - OECD defines related companies as. This determination of the sale price may be referred to as the transfer price. This course exposes various types of business documents and format which also emphasizes.

UNLIMITED clients and users. Allow multiple user to access and update a clients file concurrently.

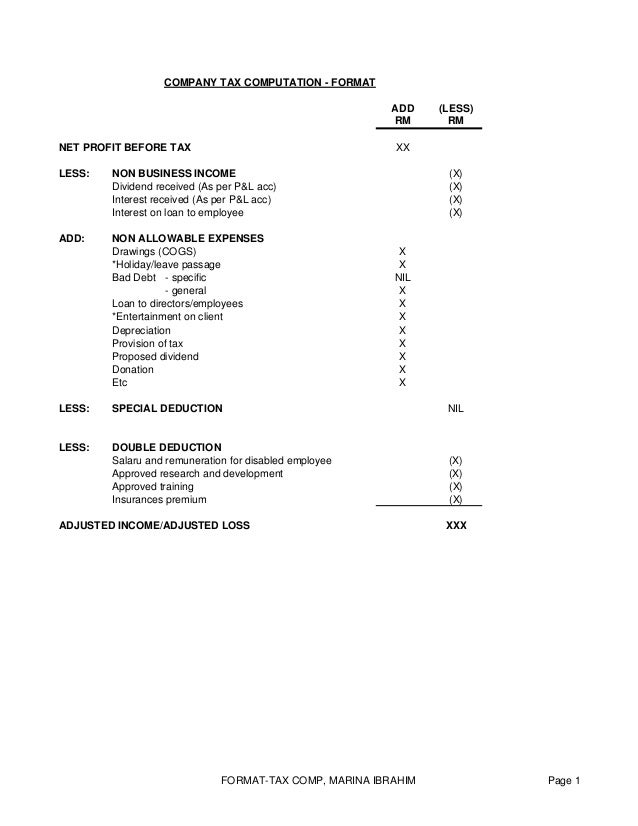

Company Tax Computation Format

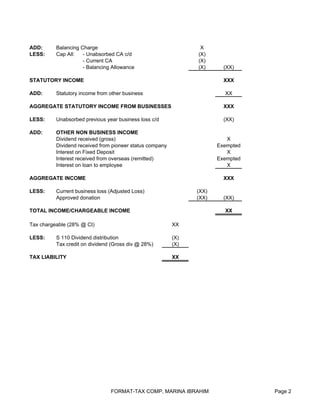

Company Tax Computation Format

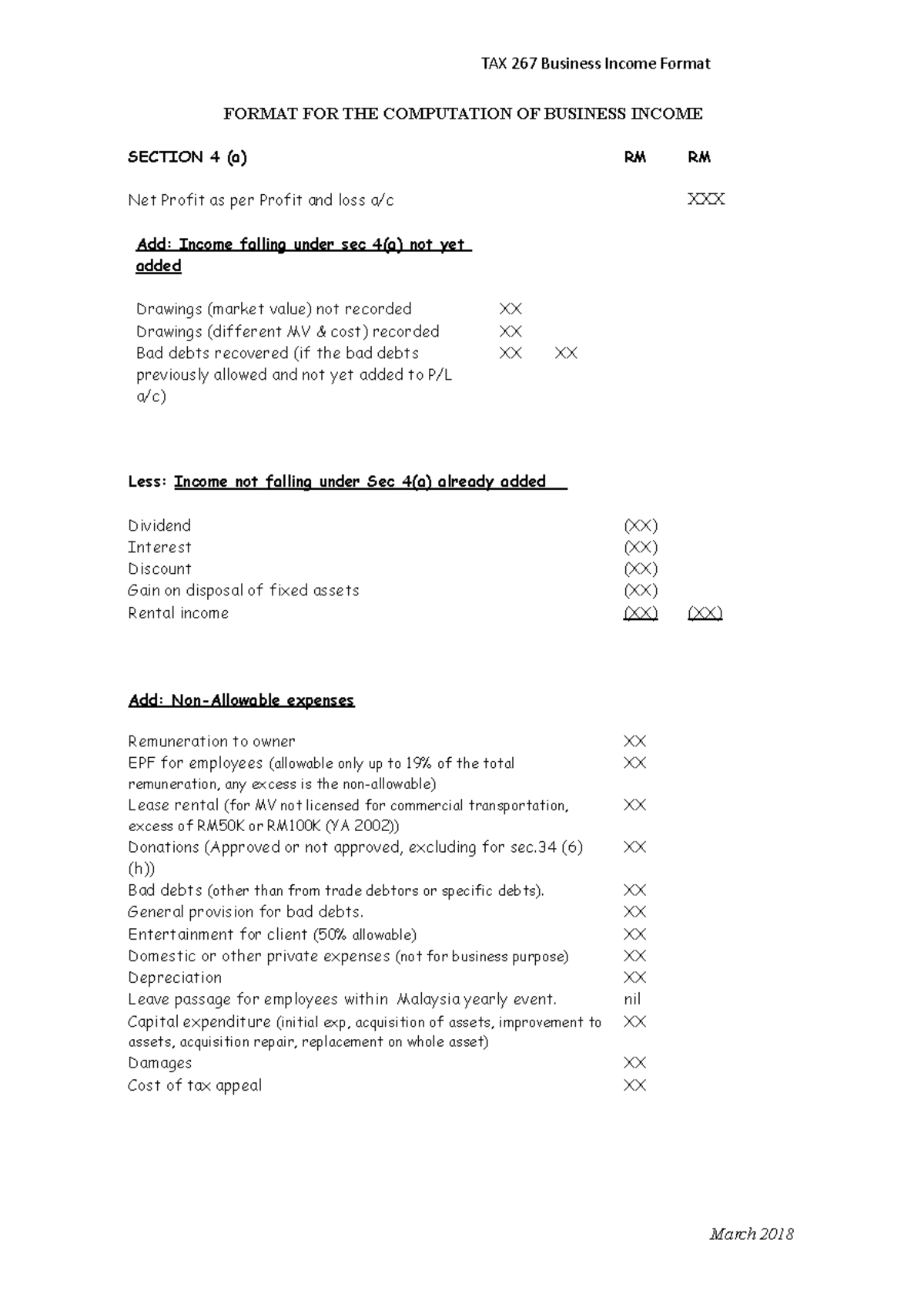

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

No comments for "Company Tax Computation Format Malaysia"

Post a Comment